Innovation activity is at a historical peak, emphasizing the need for a structured approach to manage an innovation portfolio effectively. After all, the ability to innovate consistently and effectively sets successful companies apart. An innovation portfolio is a strategic collection of all innovation-related activities within an organization. It serves as a vital tool for managing and driving sustainable growth. This article provides corporate innovation professionals with a comprehensive understanding of how to develop, manage, and optimize an innovation portfolio, aligning it with the overarching business strategy to foster growth and competitiveness.

The essence of the innovation portfolio: Core concepts and strategic importance

What is an innovation portfolio?

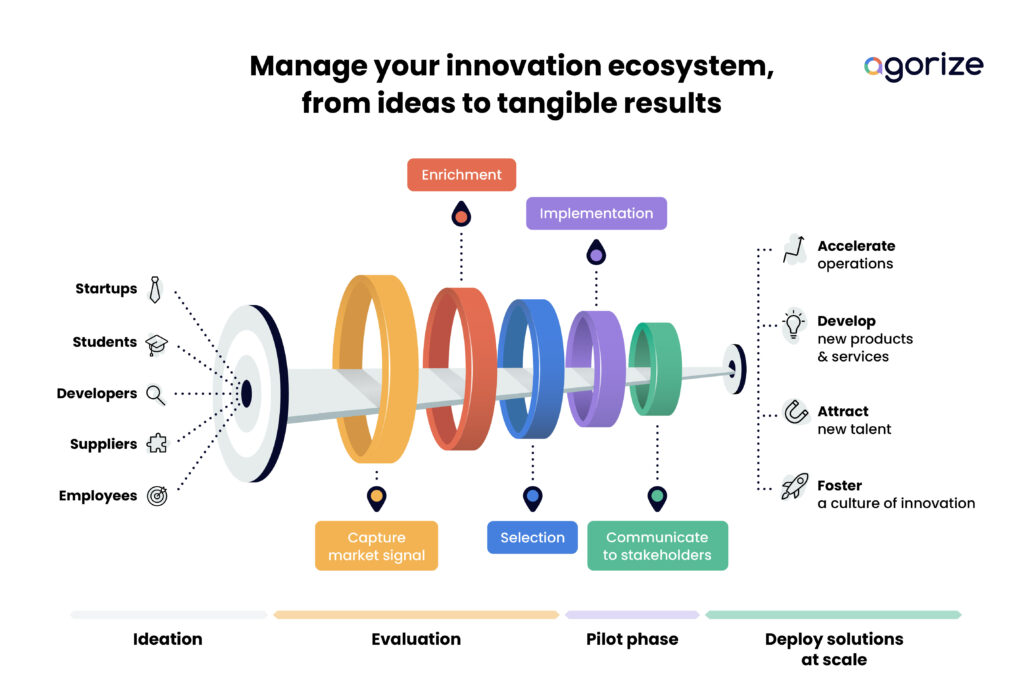

Merely generating innovative ideas is not sufficient. It is critical to have a disciplined portfolio management system to identify which ideas align with business objectives and warrant further development and investment. That’s where the innovation portfolio comes in. A portfolio encapsulates a company’s array of innovation projects, categorizing them to balance risk and reward effectively. It offers a structured approach to managing and nurturing innovations, froim ideation to implementation, ensuring they contribute positively to the organization’s strategic objectives.

The portfolio usually contains a diverse mix of project types that vary in their goals, risk levels, and time horizons. Typically, these can be categorized into:

- Incremental innovations: Enhancements or upgrades to existing products, services, or processes that aim to maintain competitiveness and meet evolving customer needs. Often, suggestions for these incremental innovations are gathered through idea boxes organized in a company’s community of employees, vendors, suppliers, and partners.

- Adjacent innovations: Projects that extend current business capabilities into new areas. These include new markets, customer segments, or technologies, leveraging existing strengths. Many organizations identify such opportunities through open innovation challenges and solution scouting. They then welcome an array of solutions and ideas from innovator communities including startups, students, developers, and employees.

- Transformational or breakthrough innovations: High-risk, high-reward projects that aim to create entirely new markets or disrupt existing ones. It often involves novel technologies or business models. Companies tend to call for technologies and startups to partner up with to develop such innovations.

Learn more about balancing incremental and transformational (radical) innovations.

Strategic imperatives of the innovation portfolio

The strategic value of a well-managed innovation portfolio lies in its ability to guide resource allocation, foster strategic alignment, and enhance decision-making processes. About 33% of transformational projects are underfunded due to inadequate methods of evaluating early-stage ideas within portfolios, according to Gartner. Providing a comprehensive view of all innovation activities enables leaders to balance short-term gains with long-term strategic growth, optimizing the innovation investment across various timelines and risk profiles.

Building the innovation portfolio: Crafting a strategic asset

Steps to developing an innovation portfolio

Creating an effective portfolio requires a clear framework that is in line with the company’s strategic goals, market positioning, and innovation ambitions. This section explains the steps it takes to develop an innovation portfolio.

- Define strategic objectives:

- Clearly articulate the organization’s long-term strategic goals and how innovation should contribute to achieving these objectives.

- Ensure there is a shared understanding among key stakeholders regarding the role of innovation in the company’s growth and competitive strategy.

- Establish criteria for how innovation projects will be evaluated regarding their alignment with these strategic objectives.

- Assess the current innovation landscape:

- Conduct an audit of existing innovation initiatives, categorizing them into incremental, adjacent, and transformational innovations based on their market impact and degree of novelty.

- Evaluate the current distribution of resources and focus across these categories to identify gaps or imbalances.

- Assess the internal and external innovation ecosystem, including capabilities, partnerships, and competitive threats, to inform portfolio decisions.

- Develop portfolio framework:

- Create a structured framework for the innovation portfolio that defines categories or themes aligned with strategic priorities, risk tolerance, and expected outcomes.

- Establish processes for idea generation, evaluation, selection, and prioritization, ensuring that they are transparent and in line with strategic goals.

- Define metrics and KPIs to measure portfolio performance and the impact of individual innovation initiatives.

- Allocate resources and launch initiatives:

- Based on the portfolio framework and strategic objectives, allocate resources (funding, people, time) across the portfolio to balance risk and reward effectively.

- Launch innovation initiatives, ensuring they have clear objectives, success metrics, and accountability.

- Foster a culture of innovation that encourages experimentation, collaboration, and learning throughout the organization.

- Monitor, evaluate, and iterate:

- Regularly review the innovation portfolio’s performance against set KPIs and strategic objectives, adjusting resource allocation and focus as needed.

- Encourage feedback loops and learning from both successes and failures to inform future innovation efforts.

- Continuously scan the internal and external environment for new trends, technologies, and market shifts that may impact the portfolio. Adjust the strategy and initiatives accordingly to maintain relevance and drive growth.

Types of innovation frameworks

Step three of building an innovation portfolio, develop a portfolio framework, can be shaped in different ways.

- Three Horizons Framework:

- Developed by McKinsey, this framework divides innovations into three categories or “horizons” based on their expected maturity and revenue generation timeline. It’s now considered outdated as companies like Uber and Airbnb prove its principles don’t always hold up.

- Horizon 1: Core innovations that improve existing products and processes for current markets.

- Horizon 2: Emerging opportunities that might create new potential for the organization, including expansion into new markets or development of new product categories.

- Horizon 3: Long-term, transformative innovations that hold the potential to redefine the industry or create entirely new markets.

- Developed by McKinsey, this framework divides innovations into three categories or “horizons” based on their expected maturity and revenue generation timeline. It’s now considered outdated as companies like Uber and Airbnb prove its principles don’t always hold up.

- Innovation Ambition Matrix: Popularized by BCG, this matrix helps companies balance their innovation efforts across three dimensions of ambition:

- Core innovations that optimize existing products for existing customers.

- Adjacent innovations that expand existing business into new elements, such as new markets, customer segments, or technologies.

- Transformational innovations that aim to create new products, services, or business models for new markets.

- Technology S-Curve Framework: This framework is based on the concept that technology performance and adoption follow an S-shaped curve over time. It starts with slow initial progress, accelerates during widespread adoption, and then levels off as the technology matures. Organizations can use this to manage their innovation portfolio by investing in emerging technologies still in the early to mid-stage of the S-curve while optimizing or phasing out mature technologies nearing saturation.

- Product Lifecycle Portfolio: This approach lines up innovation initiatives with the stages of the product lifecycle: introduction, growth, maturity, and decline. Companies can diversify their portfolio by ensuring they have products and services at different lifecycle stages, investing in new product development while optimizing or retiring mature offerings.

- Risk-Reward Portfolio Matrix: This framework categorizes innovation projects based on their risk level and potential reward. This creates a balanced portfolio that includes a mix of low-risk incremental innovations and high-risk, high-reward disruptive projects. The matrix helps organizations to visually assess their innovation investments’ risk-reward profile and make strategic decisions to balance their portfolio accordingly.

Your innovation pipeline

The innovation pipeline represents the structured process through which new ideas and concepts are generated, developed, evaluated, and transformed into valuable business outcomes. It serves as the operational flow or pathway that guides innovation from its inception stage to its final market launch or implementation within the organization. Here’s how the innovation pipeline relates to and functions within an innovation portfolio:

1. Idea generation

The innovation pipeline typically starts with the ideation phase, where companies generate a broad range of ideas through various methods such as brainstorming sessions, innovation challenges, or external collaborations. These ideas are the raw material for the pipeline and potential candidates for inclusion in the innovation portfolio.

2. Screening and evaluation

Once ideas are generated, they undergo a screening process to assess their feasibility, potential impact, alignment with strategic objectives, and fit within the portfolio’s risk and innovation type balance. This evaluation helps prioritize ideas and select the most promising ones for further development.

3. Development

Move selected ideas into the development stage, to explore and refine them through activities such as prototyping, market testing, and validation. This phase aims to de-risk the ideas, solidify their value propositions, and develop them into viable innovation projects.

4. Implementation

Ideas that successfully pass through the development phase are then implemented. This is done either by launching them in the market as new products, services, or business models or by integrating them into the organization’s internal processes or offerings. This stage marks the transition of an idea from concept to reality. Consequently contributing to the organization’s innovation output and strategic goals.

5. Portfolio management

Throughout this pipeline process, the innovation portfolio serves as the overarching framework that guides decision-making, prioritization, and resource allocation. It ensures that the pipeline is in line with strategic objectives. It also maintains a balanced mix of innovation types and adapts to changing internal and external environments.

6. Monitoring and learning

The innovation pipeline is continuously monitored to track the progress of initiatives, learn from successes and failures, and make informed decisions about advancing, pivoting, or terminating projects. These insights feed back into the portfolio strategy. Doing so helps companies to optimize the innovation pipeline and ensure it remains effective in driving sustained innovation.

Enhancing portfolio diversity and balance: Optimizing the innovation mix

Balancing an innovation portfolio can be challenging due to the inherent complexities and uncertainties involved in innovation. On top of that, there’s also the need to align diverse projects with strategic business objectives. Portfolio managers need to understand how to maintain a diverse and balanced range of projects and know how to optimize the innovation mix.

Embracing portfolio diversification in innovation

Diversification is crucial in mitigating risks and capturing a broad spectrum of innovation opportunities. A portfolio manager can embrace portfolio diversification in innovation by strategically allocating resources across a mix of projects to mitigate risks and capitalize on different growth opportunities. This involves understanding the unique risk-reward profile of each type of innovation. On top of that, it means ensuring that investments are spread across initiatives that vary in their potential impact and timelines. Additionally, the manager should actively monitor market trends, technological advancements, and internal capabilities to adjust the portfolio as needed. This fosters a culture of agility and learning. Engaging with external ecosystems and leveraging cross-industry insights can also infuse fresh perspectives and opportunities into the portfolio, enhancing its diversity and potential for breakthrough innovation.

Managing risks and uncertainties

Innovation inherently involves risk. Managing these risks involves a systematic approach. This approach includes diversifying the portfolio across various types of innovation to balance risk, implementing robust evaluation and selection processes to prioritize certain projects, and continuously monitoring the external environment for emerging trends and threats. It also requires establishing clear metrics and KPIs to assess the performance of innovations and adapt strategies proactively. Regularly reviewing and recalibrating the portfolio based on performance data and strategic objectives ensures that resources are allocated to the most promising opportunities. At the same time, it minimizes exposure to underperforming or misaligned projects. In addition, it fosters a culture that encourages experimentation and learning from failures. This can help organizations navigate uncertainties and turn potential setbacks into strategic insights. Consequently, enhancing the overall resilience and adaptability of the innovation portfolio.

Leveraging analytics and insights: Data-driven portfolio optimization

Utilizing innovation portfolio tools and technologies

In an era where data is king, leveraging the right tools and technologies can significantly enhance innovation portfolio management. This part reviews various digital solutions available for tracking, analyzing, and optimizing innovation portfolios, highlighting how they facilitate informed decision-making.

- Centralized data management

Digital solutions provide a centralized platform for capturing and managing all innovation-related data. These include ideas, projects, metrics, and outcomes. This centralized view enables portfolio managers to monitor the status and progress of various initiatives. Consequently, centralized tools make it easier to identify trends, gaps, and opportunities. - Real-time analytics and dashboards

Many digital solutions offer advanced analytics and customizable dashboards that provide real-time insights into the performance of the innovation portfolio. This allows managers to quickly assess the impact of individual efforts and the overall health of the portfolio. As a result, this supports agile decision-making. - Collaboration and communication tools

These platforms often include features that facilitate collaboration and communication among stakeholders, ensuring that everyone is aligned and informed. This can enhance the efficiency and effectiveness of innovation processes, from ideation to implementation. - Integration with other systems

Many digital solutions can integrate with other enterprise systems, such as financial, HR, and CRM platforms, providing a more comprehensive view of how innovation can align with and impact broader business objectives.

One digital solution that offers these key capabilities is Agorize. Agorize offers tools and features that are beneficial for tracking, analyzing, and optimizing various aspects of an innovation portfolio. It stands out when it comes to integrating external innovative ideas and solutions. As a result, by leveraging Agorize, chief innovation officers and leaders enhance their portfolio’s breadth and depth, integrating external innovation streams to drive growth and maintain a competitive edge in the market.

Key metrics and performance indicators

Measuring the effectiveness and impact of the innovation portfolio is critical. For example, the Innovation Pipeline Strength indicator allows managers to visualize the flow and progression of ideas or projects, identifying potential bottlenecks or stages requiring attention. Meanwhile, Strategic Alignment ensures that each innovation contributes toward the organization’s overarching goals, maintaining focus and relevance. In addition, measuring Portfolio Balance helps to manage risk and exploit diverse growth opportunities, requiring a mix of incremental, adjacent, and transformational innovations.

Time to Market and ROI

Time to Market is a critical metric that tracks how swiftly ideas turn into profitable offerings, reflecting the portfolio’s agility and market responsiveness. Finally, Innovation ROI quantifies the financial success of innovation. It compares the gains achieved against the investments made. This is vital for justifying continued investment in innovation and understanding its contribution to the company’s bottom line. Together, these KPIs provide a comprehensive view of the portfolio’s performance, guiding strategic decisions and portfolio optimization.

Read our Innovator’s Handbook breaks with all the latest trends and developments that matter to corporate innovation professionals.

Translating theory into practice: Portfolio management software

Today, any successful innovation strategy calls for software that streamlines and accelerates the innovation management process. Especially at a large scale, different types of innovation programs call for a lot of project management power that shouldn’t be done manually. The right software allows companies to manage and organize a diverse range of innovation projects and initiatives, leveraging various communities in their ecosystem.

Agorize offers such a solution. As the leading innovation and idea management platform, it has proven to accelerate the overall innovation process and individual innovation programs. The solution has helped many multinational organizations and more than 50% of BCG’s most innovative companies of 2023. Regardless of which solution you select, ensure that it meets certain essential criteria, including:

- Engage a diverse community to generate a wide range of innovative ideas and solutions, enabling you to develop new products or services

- Build a custom workflow for each innovation project

- Manage and track the progress of ideas and new projects from inception through to implementation

- Evaluate and analyze the impact of innovations, measuring return on investment

- Foster collaboration between internal teams and external innovators

An innovation portfolio is more than just a collection of projects. It is a strategic framework that, when managed effectively, can propel an organization to new heights of innovation and market leadership. The right organizational portfolio approach consists of a well-thought-out strategy, a well-suited portfolio framework, and the right tools to complete projects effectively. To learn more about how our platform can facilitate this, simply reach out to our team of innovation experts.

An innovation portfolio encapsulates a company’s array of innovation projects, categorizing them to balance risk and reward effectively. It offers a structured approach to managing and nurturing innovations, from ideation to implementation, ensuring they contribute positively to the organization’s strategic objectives.

1. Define strategic objectives

2. Assess the current innovation landscape

3. Develop a portfolio framework

4. Allocate resources and launch initiatives

5. Monitor, evaluate, and iterate